Eligibility

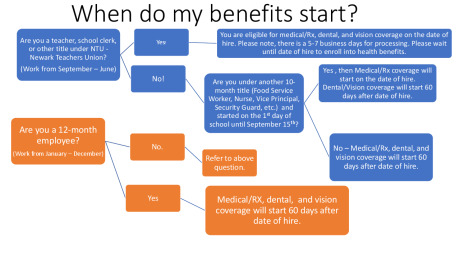

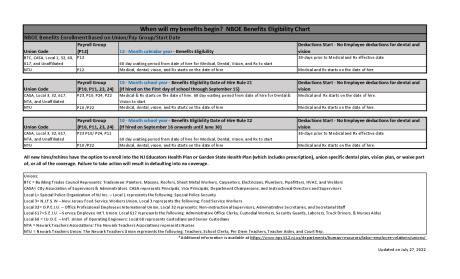

You are eligible for medical/Rx, dental, and/or vision if you are full time employee. All new hires default to elect no coverage. You will be required to take action to enroll onto health coverage. Note, the District does not issue a stipend for those who choose to waive coverage

Benefits are determined by three factors, if you are 10-month employee (i.e. teacher) or 12- month employee (i.e. clerk), date of hire within a school year, and union affiliation. Per diem staff are not eligibility for health coverage.

- For example, if you are teacher medical/Rx, dental, and/or vision will start effective the date of hire, pending elections and processing time.

- Benefits effective date will be easily outlined on your secure Benefits Enrollment WEX Profile at NBOEbenefits.com, using your school credentials (work e-mail address ending in @nps.k12.nj.us and password).

- You can enroll onto benefits only AFTER your date of hire and once your profile is set up accordingly. Please allow 5-7 business days from the date of hire for processing.

- Employees hired after July 1, 2020 can only enroll onto the NBOE NJ Educators Plan (NJEP), or NBOE Garden State Health Plan (GSHP), which includes prescription coverage, Freedom of Choice Dental, and/or Vision Plan.

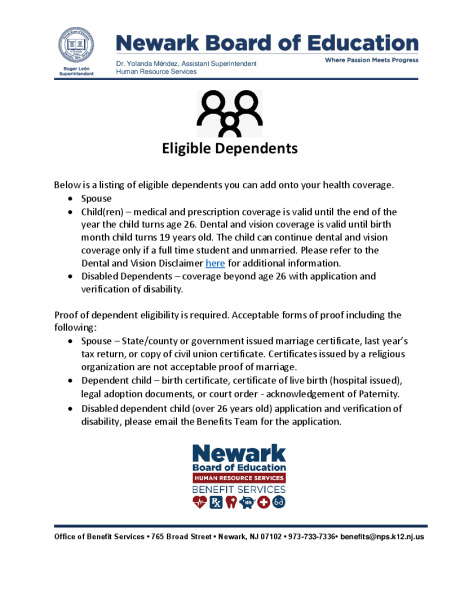

You may also enroll your eligible dependents in the same plan you choose for yourself. Proof of dependent status will be required to enroll. Eligible dependents include:

- Your legal spouse

- Your natural, adopted, stepchild, or child for whom you have legal guardianship, up to age 26

- Your disabled child over the age of 26 for whom you have legal guardianship. Additional action is required, please email benefits@NPS.K12.NJ.US to obtain the verification of disability applications.

For complete spouse and dependent children eligibility requirements, please refer to each carrier’s Certificate of Coverage.

New Hire Benefits

Employees can enroll themselves and their eligible dependent(s) onto the District’s insurance plans administered by Aetna (medical) and Express Scripts (prescription) nationwide network. (NBOE does not participate with the School Employees’ Health Benefits Program administered by the State of NJ.) Note, enrollment is completed through our Enrollment Portal, there are NO paper forms.

Please watch this webinar to learn more on Accessing my Benefits. To view a copy of the presentation, please click here

Please review these helpful videos on how to enroll. Click on the red Enroll Now button above to complete enrollment via web browser. If you prefer to use the WEX Enrollment App, please review instructions.

VIDEO - How to Enroll onto NBOEbenefits

VIDEO - Adding a Dependent onto Benefits

VIDEO - Medical and Rx Coverage Overview and

the Difference Between the

NJ Educators Plan and the

Garden State Health Plan

VIDEO - Dental Coverage

What is coverage under my

Dental Plan

New Hire Pension

TPAF Eligibility and Enrollment

Employees appointed to positions requiring certification by the New Jersey Department of Education as members of the regular teaching or professional staff are required to enroll in the TPAF as indicated on the TPAF – PERS Tier Chart and life insurance plan as a condition of your employment.

Click on the TPAF Pension Enrollment Form link to complete the form through DocuSign. Once submitted, the form will automatically be emailed to Benefits inbox.

If you print the PDF, you are only responsible to complete questions 1 through 8 for pension enrollment. Email the form to the Benefits email inbox, benefits@nps.k12.nj.us.

PERS Eligibility and Enrollment

Employees hired in non-instructional titles (clerks, custodial, attendance counselor, various administrative roles, etc.) will be required to enroll in PERS.

However, if you are hired as a temporary or provisional employee covered by Civil Service, you will not be eligible for enrollment until the beginning of the 13th month of continuous employment or the date of regular appointment, whichever comes first.

Click on the PERS Pension Enrollment Form link to complete the form through DocuSign. Once submitted, the form will automatically be emailed to Benefits inbox.

If you print the PDF, you are only responsible to complete questions 1 through 8 for pension enrollment. Email the form to the Benefits email inbox, benefits@nps.k12.nj.us.

IMPORTANT REMINDER:

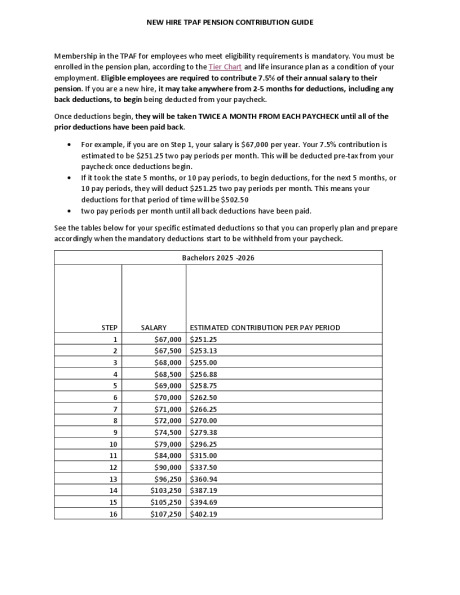

TPAF and PERS eligible employees are required to contribute 7.5% of their annual base salary to their pension. If you are a new hire, it may take anywhere from 2-5 months for deductions, including any back deductions, to begin being deducted from your paycheck.

NBOE processes pension deductions when the certification of payroll deductions is received from NJDPB. A copy of the Certification of Payroll Deductions is mailed to your home address and will show the date your pension deductions are scheduled to begin, your rate of contribution, contributory insurance requirement and any back deductions due. Refer to the Sample Certification of Payroll Deductions from NJPB and the TPAF Pension Contribution Guide for examples.

Once deductions begin, they will be taken TWICE A MONTH FROM EACH PAYCHECK until all of the prior deductions have been paid back. If you are experiencing a financial hardship, you can request a Pension Back Deductions Hardship Request, please complete the Pension Back Deductions Hardship Request form and send it to New Jersey Division of Pensions and Benefits Attn: Adjustment Section P. O. Box 295 Trenton, New Jersey 08625-0295.

TPAF/PERS Transfer

If you are currently actively enrolled in a State of New Jersey Pension Plan with your former employer and plan to transfer your pension service over to NBOE, you must complete a Report of Transfer form:

Click on the TPAF Report of Transfer Form or PERS Report of Transfer Form link to complete either form through DocuSign. Once submitted, the form will automatically be emailed to Benefits inbox.

Employee Group Contributory Life Insurance Plan

You may opt out of paying the premium for the Employee Group Contributory Life Insurance Plan after completing the first year. NBOE will continue to pay the Non-Contributory Group Life Insurance Premium. If you ever stop your life insurance premium payment you can never reinstate the policy. For more information, refer to Continuation of Personal Contributory Group Life Insurance guide.

Qualifying Life Event

Experience a Life Event? Newborn, marriage, divorce?

What is a life event?

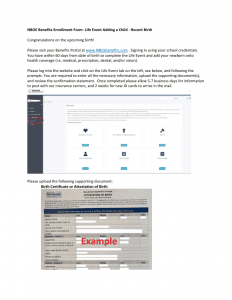

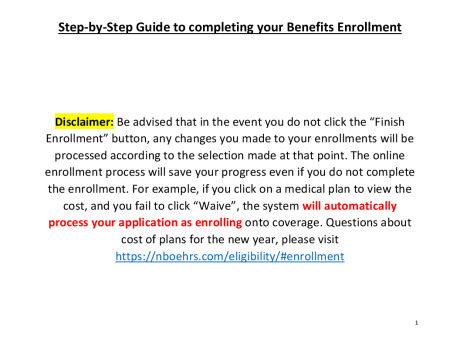

A life event, also known as a qualifying event, is a family status change (ex: birth, marriage, divorce, etc.) occurs and requires you to update your health benefit coverage information. To declare a life event, please visit your Benefits Portal at www.NBOEbenefits.com. Signing in using your school credentials. You have within 60 days from date of the event. Please log into the NBOEbenefits.com website and click on the Life Event tab on the left, click on life event that’s applicable, and follow the prompts. You are required to enter all the necessary information, upload the supporting document(s), and review the confirmation statement. Once completed please allow 5-7 business days for information to post with our insurance carriers, and two weeks for new ID cards to arrive in the mail.

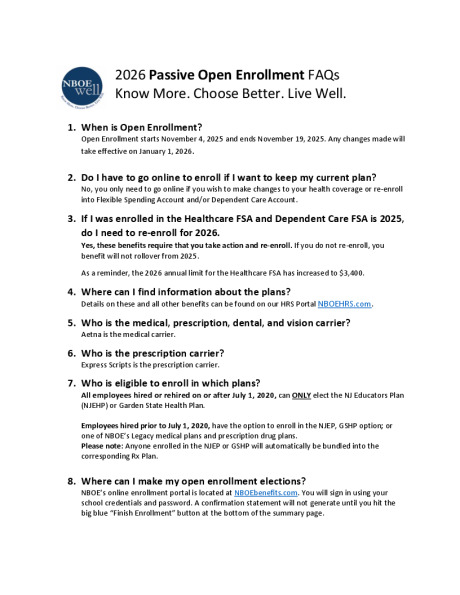

Open Enrollment will start November 4th, 2025

Open enrollment is the period each year when apply for health insurance for the upcoming year, without a qualifying life event. This is your once-a-year opportunity to pick your plans or make changes to your existing coverage.

Open Enrollment Starts Tuesday, November 4th through Wednesday, November 19th.

Reminder, this is a PASSIVE Open Enrollment period which means you do not need to take any action if you wish to keep your current Medical, Prescription, Dental and Vision plans. You only need to go to www.NBOEbenefits.com if you need to take action.

The choices you make during Open Enrollment will take effect on January 1, 2026 through June 30, 2026. All the plan options for Medical, Prescription Drugs, Dental and Vision will remain the same. You will be able to enroll in the same plans for 2026 as you had this year, including doctor networks, copays, deductibles, and out-of-pocket maximums.

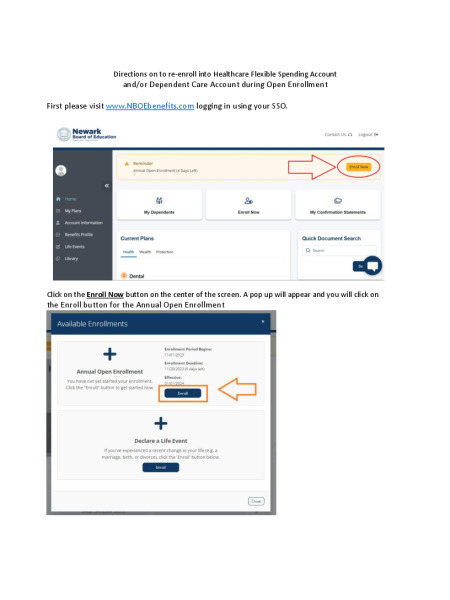

Participation in the Health Care Flexible Spending Account (FSA) or Dependent Care Account (DCA)

An Active election is required if you wish to re-enroll for your FSA or DCA for the upcoming year.

- FSA funds will be available on January 1, 2026, and payroll deductions will be processed from January 1, 2026, through December 31, 2026.

- DCA funds is “use as you accrue” set up. DCA funds are withdrawn automatically from each paycheck for deposit into your WEX DCA account before taxes. As soon as your WEX DCA account is funded, you can use your balance to pay for many eligible dependent care expenses. You may only use the funds that are available in your account, not the entire election amount.

- Use it or lose it! Unused funds at the end of the plan year are forfeited. However, the District offers a grace period to submit claims by end of February 2027.

- The 2026 pretax contribution limit for the Health Care Flexible Spending Account (FSA) is $3,400.

- The 2026 pretax contribution limit for the Dependent Care Account (DCA) is $7,500.

Starting on Tuesday, November 4th through Monday, November 19th, you will be able to enroll in your NBOE benefits from anywhere you can access the Internet at NBOEbenefits.com.

Resources

To prepare for this Open Enrollment, please review the OE Presentation, FAQs, and much more.

2026 Calculators

Please refer to the NBOE Chapter 78 Legacy 2026 Calculator – Legacy Plans Only to obtain an estimate* of your per-pay contribution for the year. This estimate can be applied to Choice POS II 1015, 2035, Select Aetna plans, or the HDHP plan.

Please refer to the NBOE Chapter 44 NJEP 2026 Calculator to obtain an estimate* of your per-pay contribution under the combined medical and prescription NJ Educators Plan (NJEP) that is a Choice POS II plan.

Please refer to the NBOE Chapter 44 GSHP 2026 Calculator to obtain an estimate* of your per-pay contribution under the combined medical and prescription Garden State Health Plan (GSHP) that is a Aetna Whole Health plan.

The GSHP offers a significantly smaller network in comparison to the other plans offered in the District. There is no coverage for out of state providers in the GSHP, except for a true emergency.

Reminder to click on the enable editing button to use the calculator.

2026 Calculators – How to Use the Calculators

About Us

The Office of Benefit Services manages and delivers the district’s benefits, focusing on the long-term health and financial well-being of our employees. We offer customer service, communications, and educational resources to help over 6,000 plan participants, including faculty, staff, and their families, maximize their benefits, pensions, and wellness programs.

The Office of Benefit Services is committed to supporting your health and financial security. We provide a comprehensive range of services and resources, including:

- Health and Welfare Benefits: Access to essential health coverage and support.

- Benefits Education, Communications, and Customer Service: Clear information, ongoing communication, and personalized assistance to help you understand and utilize your benefits effectively.

- Wellness Programs: Initiatives designed to promote your overall well-being.

- Voluntary Benefits: Optional benefits to enhance your coverage.

- Pension and Retirement Program: Resources and guidance for your long-term financial planning.

Through our health and wellness initiative, NBOE Well, the Office of Benefit Services is able to deliver first class products, programs, information, tools and resources to employees.

Our mission is to empower you to – Know More. Choose Better. And Live Well.

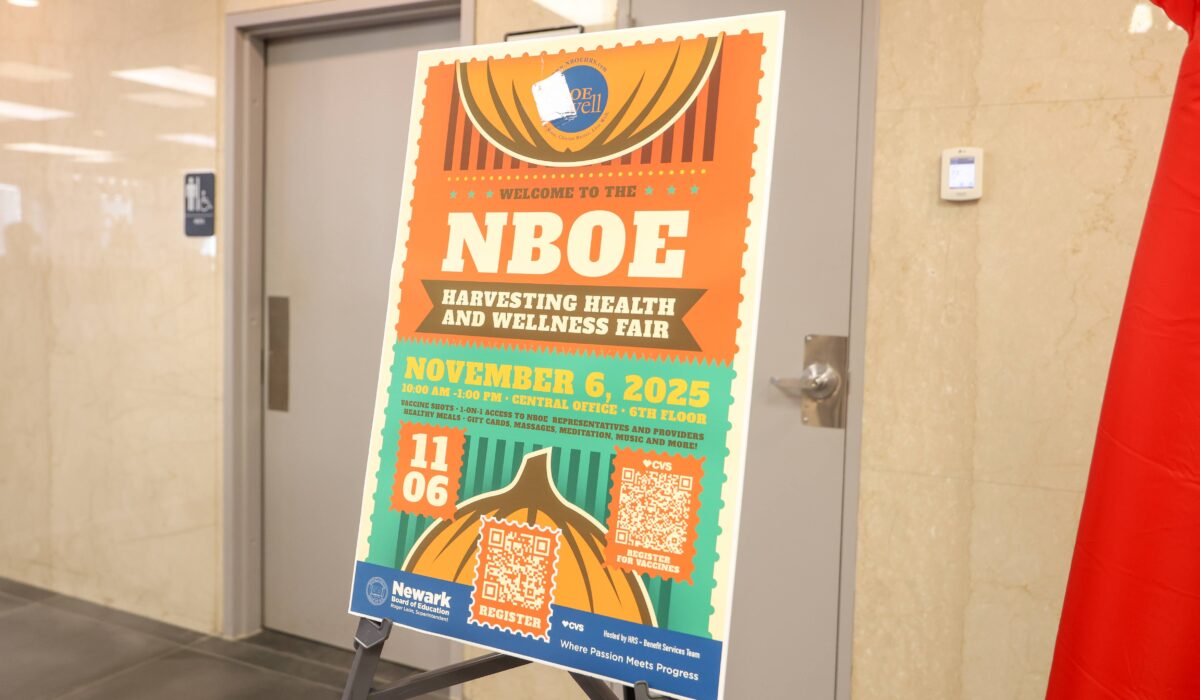

November 2025 Health & Wellness Fair

Photo Gallery!

May 2025 Health & Wellness Fair

Photo Gallery!

May 2024 Health & Wellness Fair

Photo Gallery!