Defined Contribution Retirement Program (DCRP)

The New Jersey Defined Contribution Retirement Program (NJDCRP) was established July 1, 2007, under the provisions of N.J.S.A. 43:15C-1 et seq. The DCRP provides eligible members with a tax-sheltered, defined contribution retirement benefit, along with life insurance and long-term disability coverage.

The Defined Contribution Retirement Program Board oversees the DCRP, which is administered for the NJDPB by Empower (formerly Prudential).

- Empower makes DCRP information, including information about distribution options, available on https://njplans.empower-retirement.com/participant/#/login?accu=NJRP

- Members can contact Empower by phone through this Toll Free Number: 1-866-657-3327.

- Defined Contribution Retirement Program Quarterly Newsletter

Download the DCRP Presentation

Eligibility and Enrollment

PERS and TPAF

Employees enrolled in the PERS or TPAF on or after July 1, 2007, are subject to a maximum compensation limit for pension contributions. The maximum compensation is based on the annual maximum wage for Social Security (DCRP Enrollment Max Comp Limit) and is subject to change at the start of each calendar year.

Therefore, an eligible employee who earns in excess of the annual maximum wage will be enrolled in the DCRP in addition to the PERS or TPAF (as appropriate). Employees can contribute to DCRP on wages up to the annual contribution limit under IRC section 401(a)(17).

Optional Waiver

A PERS or TPAF member who is also eligible for the DCRP due to the maximum compensation limit can choose to voluntarily waive participation in the DCRP by submitting a DCRP Waiver of Retirement Program Participation form to the New Jersey Division of Pensions & Benefits (NJDPB). If a member waives DCRP participation and later wishes to participate, he or she can apply for DCRP enrollment, with membership to be effective January 1 of the following calendar year.

Per Diem Employees

DCRP participation is mandatory, all eligible employees will automatically be enrolled once they have earned $5,000 annually.

Full Time Employees

Full time employees who work less than 32 hours per week and earn $5000 or more annually are eligible for enrollment beginning the 13th month of continuous employment or the date of regular appointment, whichever comes first.

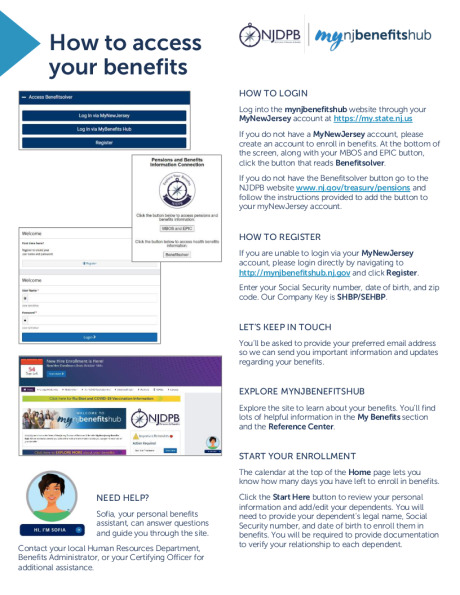

How to Enroll

Complete the DCRP Pension Enrollment Form through DocuSign. The form will automatically be emailed to the Benefits inbox.

Alternatively, you can download and submit the DCRP Enrollment Form

You are only responsible to complete questions 1 through 7 for processing into DCRP. Be sure to indicate if you are currently actively enrolled in a State of New Jersey Pension Plan with your former employer and plan to transfer your pension service over to this new location. Email the completed PDF enrollment form to the Benefits inbox, benefits@NPS.K12.NJ.US.