FSA

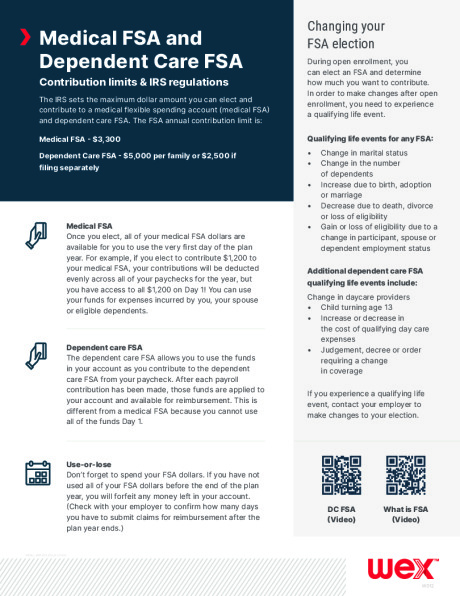

Health Care FSA: Allows you to set aside up to $3,400* a year through payroll deductions for payment of eligible health care expenses for you and your dependents. (*2026 IRS Healthcare FSA Maximum amount)

Flexible spending accounts, or FSAs, provide you with an important tax advantage that can help you pay health care and dependent care expenses on a pre-tax basis. Essentially, the Internal Revenue Service (IRS) set up FSAs as a means to provide a tax break to employees.

You can use your Health Care FSA on medical, dental and vision expenses that are not reimbursed by insurance. You can also use it for many over-the-counter products.

For a full list of eligible expenses, please visit here

As an employee, you agree to set aside a portion of your pre-tax salary in an account, and that money is deducted from your paycheck over the course of the year. The amount you contribute to the FSA is not subject to social security (FICA), federal, state or local income taxes — effectively adjusting your taxable salary.

The taxes you pay each paycheck and collectively each plan year can be reduced significantly, depending on your tax bracket. As a result of the personal tax savings you incur, your spendable income will increase.

Reminder: You do have a grace period until the end of February to use the funds from the previous year, otherwise it will be forfeited per IRS guidelines.

All claims incurred during the plan year, or while you were a participant in the plan, must be submitted by the end of the designated grace period (end of February) as contained in the Summary Plan Description.

Should you wait until the end of this grace period to submit your claims, you run the risk of forfeiture of any unused amounts in your account should your claim not include all the necessary documentation required. Any new claims or documentation submitted after the grace period cannot be considered for reimbursement.

Dependent Care Flexible Spending Account (DCA)

Dependent Care FSA (also known as DCA)

Allows you to set aside up to $7,500 if married/single or $3,750 if married-filing separate through payroll deductions for eligible dependent care expenses (*2026 IRS Dependent Care Flexible Spending Account Maximum amount).

Dependent Care FSA or DCA funds is “use as you accrue” set up. DCA funds are withdrawn automatically from each paycheck for deposit into your WEX DCA account before taxes. As soon as your WEX DCA account is funded, you can use your balance to pay for many eligible dependent care expenses. You may only use the funds that are available in your account, not the entire election amount.