ACA 1095

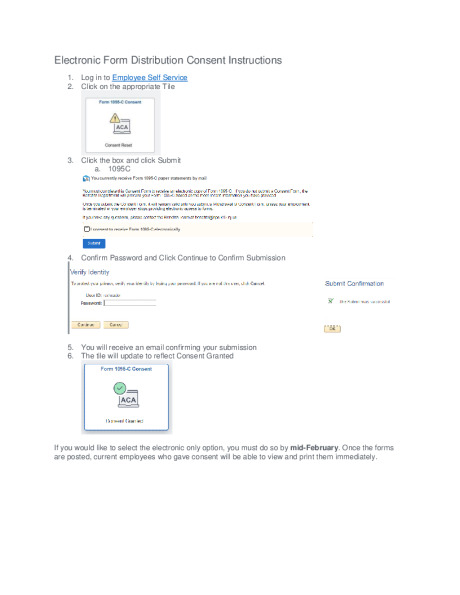

Every year, you are required to sign up for electronic copy of your ACA 1095 form. Click here for instructions

Note, the Newark Board of Education mails 1095Cs (ACA) forms to every applicable employee. You now have the option to skip the mailed forms, in favor of online access only through Employee Self Service. By selecting this option, you will only be able to access the forms through Employee Self Service.

When will the Form 1095 C be available?

Employees will have access to their 1095-C 2025 Form on or before March 2, 2026.

What is Form 1095-C?

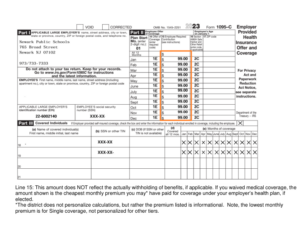

Form 1095-C, titled Employer-Provided Health Insurance Offer and Coverage, is a statement of health coverage offered to eligible employees.

What’s included on Form 1095-C?

Form 1095-C will indicate your name and NBOE’s information, the months during the prior calendar year when you were eligible for coverage, and the cost of the cheapest monthly premium* you could have paid for coverage under your employer’s health plan. This does not mean you paid for this in your withholdings. Questions about the deductions on your paystub, please check out this presentation or visit /payroll/

*The district does not personalize calculations, but rather the premium listed is informational. Note, the lowest monthly premium is for Single coverage, not personalized for other tiers.

Do I need to attach Form 1095-C to my tax return?

No. Although you may use the information on the forms to help complete your tax return, these forms should not be attached to your return or sent to the IRS.

Who has to file Form 1095-C?

The health care law defines which employers must offer health insurance to their workers. The law refers to them as “applicable large employers,” or ALEs. A company or organization is an ALE if it has at least 50 full-time workers or full-time equivalents.

Eligible employees who decline to participate in their employer’s health plan will still receive a 1095-C.