Commuter Benefits

Section 132(f) Qualified Transportation Benefits, also known as Commuter Benefits, are fringe benefits to help participants reduce the cost of commuting to and from work. Under Section 132(f) of the Internal Revenue Code (IRC) employees are permitted to pay for commuter vehicle expenses, transit passes, and qualified parking expenses on a tax-favored (pre-tax) basis.

Pre-tax commuter benefits are available in two separate “spending accounts”:

Commuter Transit Spending Account – Transportation cost associated with a commuter highway vehicle for travel between an employee’s residence and place of employment, and any transit pass can be pre-taxed.

Parking Spending Account – Qualified Parking Expense can be pre-taxed.

How Commuter Transit Spending Accounts Work

An employee may establish a spending account to reimburse predictable expenses incurred for out-of-pocket commuter and transit expenses. Once they determine their annual predictable expenses for the period of time covered by the Plan Year, a portion of that amount may be paid for with pre-tax pay, the elected pre-tax pay amount is then deposited on a per pay basis to the spending account. The maximum pretax deferral allowed for 2024 is $315 per month for the Commuter and Transit Spending Account.

Unlike the typical Flexible Spending Account(FSA), employees can change their election amount at any time during the Plan year. In addition, unused balances at the end of the year can be carried over to the next Plan year. However, any unused balance upon termination of employment could be forfeited.

What happens to unused Commuter Card funds

If you leave you terminate or cancel your benefit, you have until the end of your last benefit month to use all remaining funds on your Card, subject to the monthly cap of $300.00 for transit, vanpools and commuter parking. You will forfeit all unused pretax and post-tax funds. If you have added post-tax money from a personal debit or credit card or bank account, the post-tax money will be returned to you.

What happens to my unclaimed Commuter funds

If you leave terminate or cancel your benefit, your Commuter Cash-Back account will be closed 30 days after the end of your last benefit month. During this 30-day grace period, you may submit claims only for expenses incurred prior to the end of your last benefit month. Any balance remaining in your Cash-Back account after the grace period will be forfeited.

How Parking Spending Accounts Work

An employee may establish a spending account to reimburse predictable expenses incurred for qualified parking expenses. Once he or she has determined their annual predictable expenses for the period of time covered by the Plan Year, a portion of that amount may be paid for with pretax pay, deposited on a per pay basis to the spending account, which was elected. The maximum pretax deferral allowed for 2024 is $315 per month.

Unlike Flexible Spending Accounts, employees can change their election amount at any time during the Plan year. In addition, unused balances at the end of the year can be carried over to the next Plan year. However, any unused balance upon termination of employment could be forfeited.

How to enroll, stop, or increase into the Commuter Transit or Parking Program

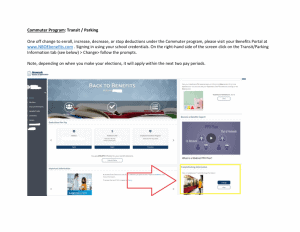

To sign up for the Commuter Program benefits follow the directions outline below.